Credit score scores are important in lots of monetary transactions, corresponding to getting a enterprise mortgage and buying a automobile. A credit score rating can be a consideration on the subject of employment and authorized issues. That’s why it’s a should to realize and keep credit score rating as a lot as you possibly can.

Are you a brand new graduate or a younger skilled incomes a good wage in your every day wants? Maybe you’re the breadwinner in your loved ones or an aspiring entrepreneur who’s planning to begin a small enterprise in a few months? In case your reply to any of these is ‘sure,’ then it’s best to maintain studying to be taught extra about what a superb credit score rating can do for you.

Listed here are the highest advantages of getting credit score rating:

Finish A Unhealthy Credit score Cycle

It’s essential to take care of credit score rating to keep away from getting caught up in a a bad credit score cycle or borrowing cash from a financial institution or lending firm and barely paying on time due to numerous causes. For those who’re already in that scenario, it’s best to nonetheless attempt to get out of it by discovering methods to enhance your credit score rating.

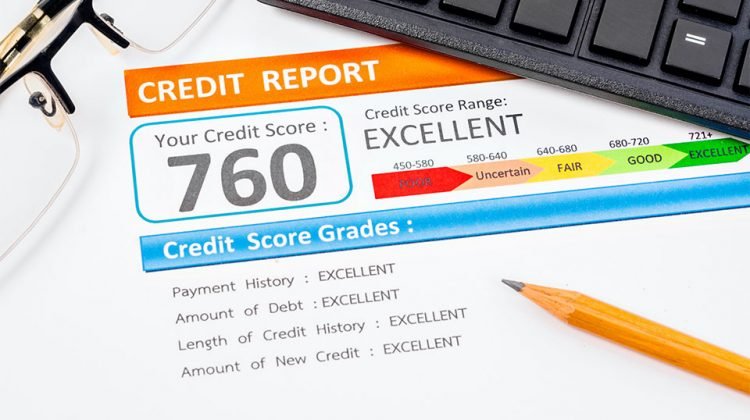

It’s doable to extend your credit score rating by 100 factors by altering your spending habits, in accordance with Credit score Robust. Credit score scores are calculated based mostly on cost historical past, size of credit score historical past, quantities owed, new credit score, and credit score combine or a mixture of various credit score profile varieties. So given these parameters, you possibly can escape from a cycle of a bad credit score should you do the next:

- Assessment your credit score report usually.

- Pay your payments on time.

- Keep away from getting new credit score.

- Request late cost forgiveness.

- Keep a low bank card stability.

Enhance Your Monetary Credibility

When lenders test mortgage functions, they take into account the borrower’s creditworthiness. You probably have a poor credit score rating, the financial institution or lending firm will probably ask you to offer extra proof of earnings or paperwork to additional assess your functionality to repay your mortgage. You may get accredited for a decrease quantity or, within the worst case, your software will probably be denied. You’ll be able to test your personal credit score rating at no cost right here.

To spice up your monetary credibility and obtain credit score rating, keep away from solely paying the minimal quantity of your bank card stability. As an alternative, repay as a lot as you possibly can by making bigger month-to-month funds or extra frequent weekly funds to decrease your principal stability shortly and considerably.

With credit score rating, you’ll earn a lender’s belief and luxuriate in extra advantages corresponding to:

- Receiving proactive affords to extend your credit score restrict

- Doubling or tripling your reward factors due to good cost historical past

- Getting particular reductions and freebies

- Getting access to decrease rates of interest

Construct Wealth

In fact, having credit score rating is an enormous plus on the subject of constructing wealth. You probably have credit score standing, you possibly can simply apply for a enterprise mortgage to finance your startup.

If you wish to construct wealth and keep away from monetary problem, you need to do the next:

Use Loans For Their Supposed Goal

Solely take into consideration borrowing cash if you wish to finance a extremely worthwhile small enterprise. This can permit you to develop your operations and earn extra so you possibly can simply repay your mortgage. Nonetheless, not all folks can handle borrowed cash correctly. Some find yourself spending the complete quantity on issues that don’t have anything to do with what they took out a mortgage for. That’s the place monetary planning comes into play.

Funds Your Cash Correctly

Follow good budgeting and follow it. Resist shopping for issues not included in your must-have listing, and don’t bask in impulsive purchases.

Be taught From The Specialists

In your free time, you possibly can learn finance- and business-related articles corresponding to these on Digital Honey to get extra details about attaining credit score rating. Additionally, in doing so, you’ll uncover totally different methods on higher deal with your funds. If you maintain abreast of the newest information about credit score administration, saving, and enterprise, you’ll be extra outfitted to construct wealth over time.

Have A Happier And Much less Aggravating Life

A very good credit score rating, together with enough financial savings and manageable credit score, equates to monetary freedom. You’ll much less probably fear about cash as a result of you already know that you would be able to simply ask the assistance of banks or lending corporations in case you want some funds for emergencies or your small business.

Conclusion

It’s not too late to construct or rebuild your credit score rating. You’ll be able to apply the guidelines above so as to handle your cash effectively. It’s alright to borrow cash, particularly should you’re planning to place up a enterprise that may generate good earnings. Nonetheless, simply ensure that to maintain your credit score rating in test and arm your self with the correct information, abilities, and instruments to realize your monetary objectives.